Should Investors Pay Attention to Tata Power’s Current Share Price?

Over the last year, the share price of a large power utility firm has experienced tremendous volatility. While the corporation has a long and illustrious history in the power industry, recent performance has some investors wondering whether it is time to purchase, hold, or sell shares. Let us look at the important elements driving the current tata power share price and provide insight into what investors should think about.

Financial Results

The company’s financial performance in recent quarters has been uneven. Revenue has continually increased, owing mostly to increased power demand and pricing increases. Rising gasoline expenses, on the other hand, have reduced operating profits. While top-line growth is positive, profitability is still an issue. High debt levels, albeit steadily decreasing, continue to weigh on the balance sheet. To increase profitability and reduce debt, the corporation has implemented many cost-cutting measures and asset monetization programs. However, the benefits of these measures may not be completely obvious in financial outcomes for some time.

Outlook for the Sector and the Regulatory Environment

The future for the electricity sector remains positive, supported by India’s strong economic growth and industrialization. Although per capita power consumption is increasing, it remains lower than in other developing countries, showing great room for expansion. The organization is in a good position to gain from rising electricity consumption. Power tariffs are now controlled by a sector regulator, ensuring prompt cost pass-through. However, disagreements over retroactive tariff hikes and payment of dues by distribution businesses persist. The resolution of such difficulties is critical for reliable cash flows. Changes in the sector include a greater emphasis on renewable energy and privatization efforts, all of which may bring up new opportunities but also introduce transition hazards.

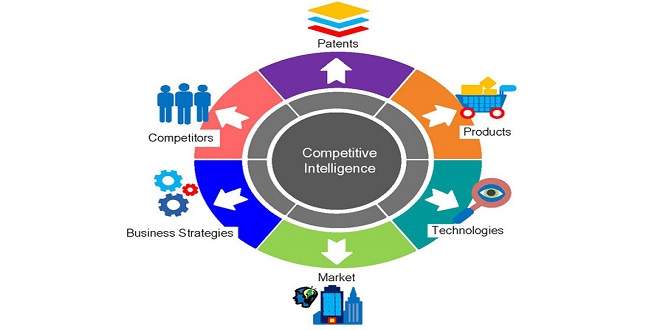

Valuation and Technical Considerations

On valuation criteria, the stock is selling at a lower multiple than its historical norm, indicating concerns about near-term earnings growth and the balance sheet. A long-term perspective, on the other hand, would consider the company’s dominant position, great development potential in the power industry, and ongoing measures to enhance profitability and reduce debt levels. Technically, the share price has found support near current levels several times in the last year. A decisive break above recent highs could spark new purchasing and propel the stock higher.

Considerations for Risks

While the long-term prognosis remains optimistic, near-term performance may continue to be hampered by high gasoline prices, payment challenges in the distribution segment, and tariff change delays. Any changes in the power sector’s regulations or policies may have an impact on operations. Rising interest rates present an additional burden. Execution risks associated with big capital expenditure plans and asset monetization schemes must also be closely monitored. Unfavorable macroeconomic conditions may exacerbate industrial and commercial power consumption.

Conclusion

In a nutshell, Tata Power stands strong in India’s evolving power sector, backed by a solid balance sheet and ongoing efforts to enhance profitability, promising long-term gains. Yet, immediate prospects may pose challenges. Strategic investors eyeing a 3-5-year horizon could find value in accumulating the stock during dips, while short-term traders are advised to wait for enhanced earnings visibility. Keep a close watch on fuel costs, tariff adjustments, macroeconomic shifts, and the effective execution of capital plans for insights into potential upside. Adding a touch of 5paisa, every fraction counts in this dynamic market landscape.